Attempts to choke chip supply to China backfiring

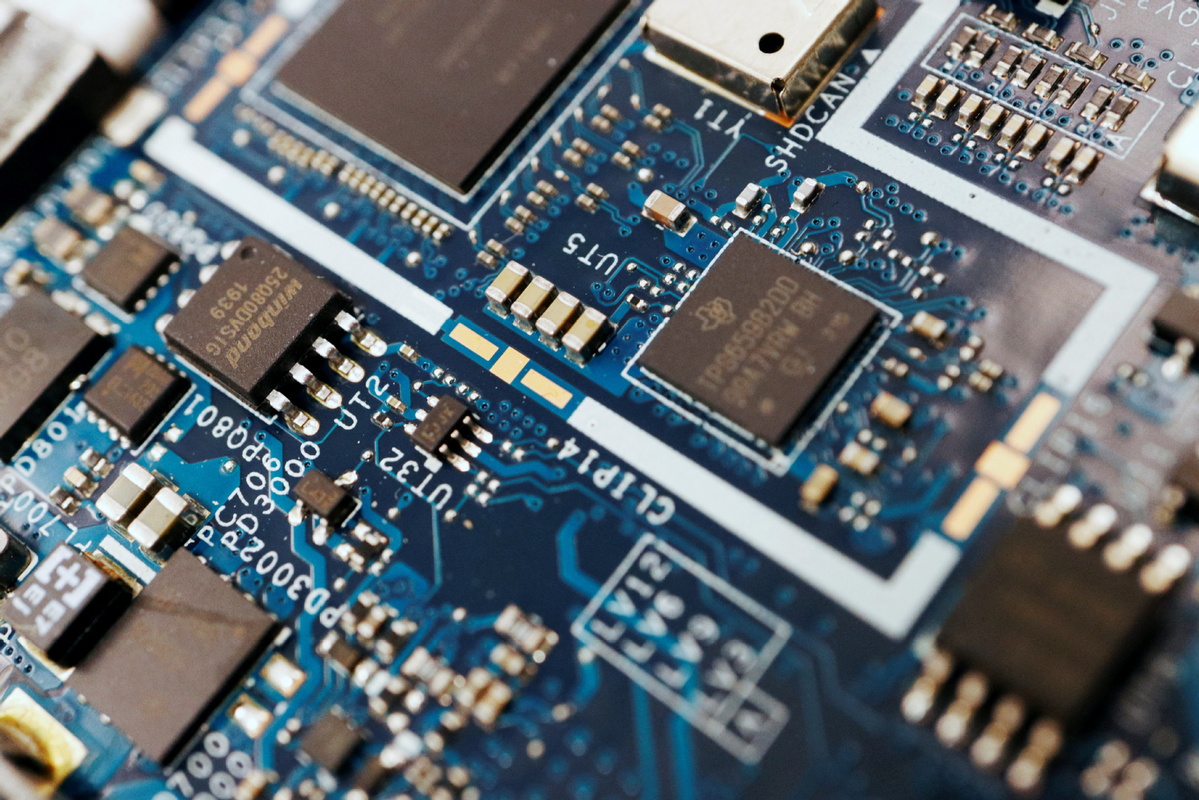

The United States has a small problem with China. In fact, it's smaller than small — a tiny matter a mere 2 billionths of a meter long or 2 nanometers — to be exact. That is the width of each of the billions of transistors packed into the centimeter-sized "next generation" of microchips that are already being produced on a limited basis in the US and China's Taiwan region.

For the administrations of US President Donald Trump and his predecessor Joe Biden, these have been a persistent source of immense anxiety, relating as they do to China's desire to manufacture its own such ultra-diminutive circuitry.

In December 2024, the Biden administration's Department of Commerce slapped the latest round of US semiconductor export restrictions on China.

Now, the new US administration's Department of Commerce has expanded Biden's bans to include dozens of new companies, claiming, as usual, national security concerns. The sanctions regime has also been deepened to block chip trade with firms that are simply affiliated with blacklisted Chinese entities.

US semiconductor giant Nvidia and other Silicon Valley chipmakers — their profits already eroded from Biden-era lockouts of chip trade with China — immediately complained of the further losses in revenue awaiting them.

Previous US volleys have included a 2019 ban on sales to China of extreme ultraviolet — or EUV — lithography machines, which are necessary for the creation of advanced chips.

That restriction extended beyond domestic licensing and selling, to apply to outfits in Japan and the Netherlands, where the Dutch ASML corporation maintains a monopoly on EUV tech.

The December restrictions increase the number of semiconductor-linked products that ASML is forbidden to offer to Chinese firms. ASML uses a patented system of lasers, tin plasma and extra-smooth mirrors from Germany's Zeiss optics to etch semiconductor circuits at the envelope-pushing scale of 7 nm, 5 nm, 3 nm, and, as of this year, down to 2 nm levels.

Such next-generation chips markedly improve processing ability and speed, while reducing energy consumption. They bestow a competitive advantage on smartphone, tablet and laptop makers that are allowed to obtain them, and to the creators of top-notch artificial intelligence software.

The world's primary manufacturer of the elite chips is Taiwan Semiconductor Manufacturing Company in China's Taiwan region, which has legal rights to use the coveted ASML machines and EUV process. Inside this tall walled trade labyrinth, tech giants Apple, Samsung, Nvidia, Sony, Intel and other US-blessed corporations enjoy a free and open path to domination over their rivals on the Chinese mainland, who are iced out of international sales by the export sanctions. The US' geostrategic weaponization of Taiwan against the Chinese mainland is also reinforced, both economically and psychologically.

Or so it is hoped by Washington policymakers. As the situation develops, however, the plan is falling apart. It also appears to be profoundly backfiring on them.

In 2022, fearful as always of China's global economic ascent, the US enacted its first broad-based set of export restrictions against Chinese semiconductor firms, seeking to hobble them in a larger fashion than did previous, more target-specific bans.

That same year, the US Congress promised $52.7 billion in taxpayer-funded subsidies to the domestic semiconductor industry through the CHIPS and Science Act, signed into law by Biden in 2022.

But in an unintended upshot, these measures served to inspire and mobilize China's government, microchip foundries and engineers to innovate in the high-end chips arena as never before; a defiant, strongly determined response that was quite predictable, given that China boasts many of the world's microchip experts, and that by 2022 it had already attained primacy among nations in global sales of the "legacy" above-28 nm level microchips.

These legacy chips, more powerful than their next-gen younger cousins, remain the standard, indispensable type for laptops, smartphones, home appliances, automobiles and many more items. Chinese semiconductor titans Semiconductor Manufacturing International Corporation and Shanghai Micro Electronics Equipment have been steadily increasing their mass production levels for the past decade, with an eye toward national self-sufficiency in semiconductor materials.

For the last three years, China has been pouring tens of billions of dollars in State funds into focused efforts of its semiconductor industry to bridge the legacy-to-advanced chip gap. And China's nanoscale innovators have been eager to progress to the next level.

The result? In the past year, Chinese teams have managed to create their own 5 nm and 3 nm chips in tests, soon to reach the key 2 nm level, and in so doing they have innovated an entirely new method of EUV advanced-chip lithography.

In addition, the new process, called "laser-induced discharge plasma", or LDP, is poised to upend the entire semiconductor industry and markets worldwide, as the LDP method and machinery consume less energy than the Dutch EUV system, making them cheaper to use.

The made-in-China lower price tag on advanced chips will make the ASML process obsolete, breaking the company's US-enforced chokehold on global sales. And as a semiconductor field maxim puts it, "today's next-generation chips are tomorrow's legacy chips".

The turn of events is remindful of how the US drive to outdo China in AI programs spurred on the creation of DeepSeek, but with far deeper implications for the world.

And so the next 10 years will likely see China enjoying a solid lead in market share for all types of semiconductor products, including next-gen chips specialized for advanced military applications, AI and machine learning, and the scientific holy grail of quantum computer processing.

China's Shanghai Micro Electronics Equipment and smartphone makers Huawei and Xiaomi are speedily building LDP machines, with Huawei engaging legacy-chip producer Semiconductor Manufacturing International Corporation to install the LDP units at its fabrication plants.

All this is precisely the globe-impacting situation that Washington had been trying to avert. And Taiwan's $781 billion TSMC cartel will probably get cratered in the process. Talk about a plan backfiring.

The US, as the superpower, is not only shoveling silicon-laden sand against the tide, it is pushing its prettiest sandcastles into the lapping, oceanic waves.

The author is an independent historian specializing in Northeast Asia. His book A Plague Upon Humanity: The Secret Genocide of Axis Japan's Germ Warfare Operation has been featured in major US media outlets.