WSJ: Who will pay the price for Trump's economic goals?

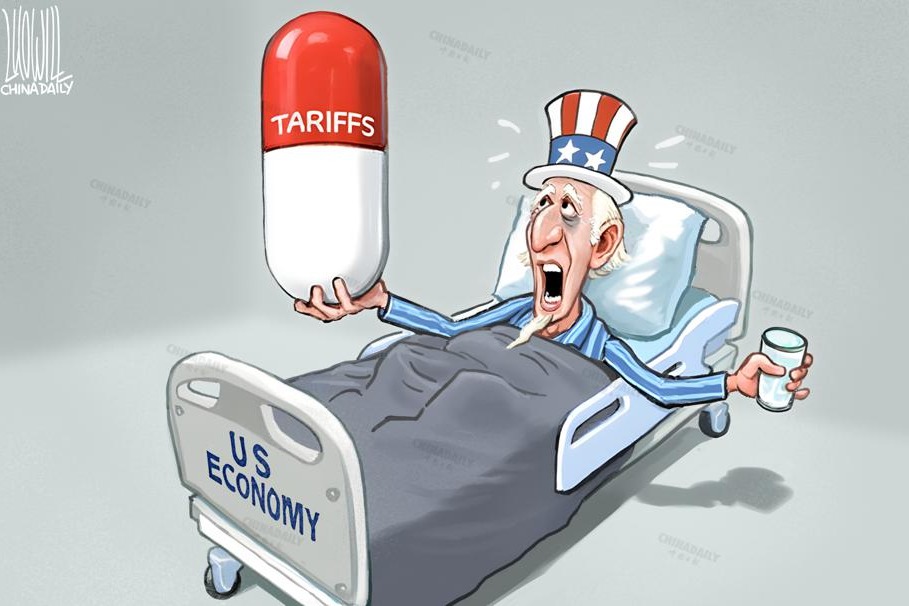

Two things are clear about Trump's tariff policy: He aims to reduce the trade deficit and revive US manufacturing. However, instead of achieving those goals, Trump's tariffs could lead to more expensive goods, fewer choices for consumers, higher interest rates, lower stock prices and a weaker dollar, according to an article published on the Wall Street Journal website on April 19.

The article pointed out that the tariffs could drive up prices and limit consumer choice. It described the tariffs as "amounting to the largest tax increase in decades," effectively acting as government "savings" while pushing up the cost of almost all imported goods.

It noted that tariffs could lead to "higher interest rates". By slashing the trade deficit, the net inflow of foreign capital could dry up, increasing borrowing costs for companies and putting downward pressure on stock prices.

In addition, the article cautioned that tariffs could push stock prices lower. Even if foreign investments are directed toward building factories to support the revival of manufacturing, it would mean less foreign purchasing of US stocks and bonds, ultimately weighing on the stock market.

Finally, the article warned that tariffs would weaken the dollar. It noted that the dollar's status as a safe haven for global savings could come under pressure. Reserve holders may fear being cut off from their assets, while shrinking global trade and concerns over the reliability of US law to protect investors' assets could further undermine confidence in the dollar.